Over many years the government has used different types of capital allowance to boost business investment and, on 3 March 2021, to help with the economic recovery from the COVID-19 pandemic, the Chancellor announced two new enhanced capital allowances – the ‘super deduction’ and the ‘SR allowance’.

What are the new allowances?

Both the new allowances give businesses investing in qualifying equipment a much higher tax deduction in the tax year of purchase than would otherwise normally occur – a ‘first year allowance’ (FYA). The allowances apply for capital investments made between 1 April 2021 and 31 March 2023.

These new FYAs are only available to companies subject to corporation tax (not individuals, partnerships or LLPs) and only where the contract for the plant and machinery (including fixtures installed under a construction contract) was entered into after 3 March 2021 and expenditure is incurred after 1 April 2021.

These allowances will be available in addition to the ongoing Annual Investment Allowance (AIA) which already gives 100% relief for costs of qualifying plant and machinery in the tax year of purchase. The AIA has been set at £1m per business again for 2021.

What investments qualify?

Although not all business investments will qualify for the new allowances, the qualifying groups are quite wide:

- ‘Super deduction’ includes all new plant and machinery that ordinarily qualifies for the 18% main pool rate of writing down allowances

- ‘SR allowance’ covers new plant and machinery qualifying for special rate pool, including integral features in a building and long-life assets.

However, it is important to remember that certain assets do not qualify for the main pool (for example, cars have their own capital allowance rates) and that second hand assets will just go into the pools as normal.

In addition, the new allowances do not apply to assets that fall into the relevant pools but are used for leasing. Therefore, integral features or plant and machinery fixtures installed in a building that is let will not qualify for the new relief. Similarly, expensive machinery acquired by hire businesses will not qualify.

This means that property investors, landlords and any groups with ‘PropCo’/‘OpCo’ structures will not generally be able claim the new ‘super-deduction’ and ‘SR’ allowance for most of their capital costs. However, it is important to note the leasing exclusion is for leased plant and machinery; not specifically landlords or investors. Therefore, if a landlord owns plant that is technically not leased, for instance fixtures within landlord areas of properties (such as reception areas, stair cores and lift lobbies) the cost of these may qualify for the new FYAs.

Furthermore, the leased plant and machinery exclusion does not extend to the provision of services that includes the leasing of plant and machinery. Examples would include serviced office providers and hirers of plant and machinery alongside dedicated operatives of that plant and machinery (for instance cranes and bulldozers with hired operatives). It will be important to consider the contractual arrangements entered into and whether plant and machinery are actually subject to a lease or not.

How much tax relief can you get?

The super deduction gives relief at 130% of the qualifying cost compared to the usual 18% writing down allowance for investment in main pool plant and machinery assets. The SR allowance gives relief at 50% of the qualifying cost in the first year with the balance going into the normal special rate pool to be written down at the usual 6% rate in future years.

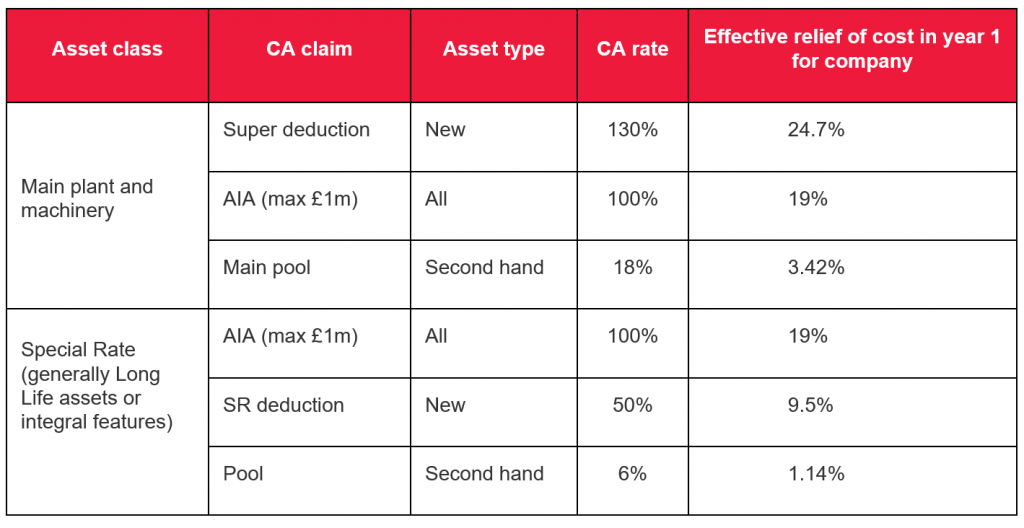

For all companies that can claim it, the super deduction will be more beneficial than claiming the AIA for main pool asset purchases. However, for smaller companies, it may still be beneficial to claim the AIA in the first instance rather than the SR allowance on relevant assets, unless the total expenditure on special rate pool assets exceeds the AIA threshold of £1m. The table below shows the effective rates of relief for the different claims but, as always, your capital allowance claims for each year will need to be compiled with care to ensure that your business gets the most optimised benefit overall.

For Example:

Gross Cost of CleanLight = £10,000

Profit reduced with super deduction = £13,000

Super deduction relief (at 19%) = £2,470

Net cost of installation = £7,530

To talk to Lightico about how CleanLight can offer a safe, long life, maintenance-free solution to clean air get in touch below: